After last week’s more theoretical discussion on the what-ifs of the US education system, Crash Course comes back to hard textbook economics in week 24. What’s even better is that this week’s topic falls within microeconomics, which is the most agreeable and least controversial area of economics.

Crash Course doesn’t make any objectionable comments in this video, but there are some points I’d like to flesh out, especially because I know it’ll be helpful when reviewing future episodes. Let’s get to it:

Opportunity Costs

Let’s say a lawyer stops practicing law and decides to open up a pizza parlor. Let’s say his total revenue from selling pizza is $50,000 and he has to pay $20,000 to cover stuff like the ingredients, the oven, rent, and wages. Now, an accountant would calculate his profit, the revenue minus the costs, as $30,000. Not bad. But an economist recognizes that there‘s a cost missing: the opportunity cost. Our pizza entrepreneur loses the income he would have earned by being a lawyer, let’s say $100,000. If you factor that in, he is actually losing $70,000.

The concept of opportunity costs is so fundamental to economics, it cannot be overstated. Crash Course’s example is spot on here with the example of a private business owner.

However, this principle of opportunity cost might be even more important in public policy work. When a government spends tax revenue on a particular project, it’s easy to look at the project and say “Wow, how great is this! We didn’t have this thing before, and now we do! Thanks government!”

The problem occurs when you think about all the other places the money could have gone. For example, instead of building an expensive statue in town square, the city government could have built shelters for the homeless, fix the potholes in the street, or subsidize a local medical clinic. Or even better (to many economists), the money could be left in the hands of taxpayers, and then they can decide where to spend their money (spoiler: it probably wouldn’t be on a statue).

This problem of opportunity costs for public projects only gets bigger if you look at larger governments. For example, the US federal government spent $3 million to research obesity rates for lesbians. Do you think that, maybe, the money could be better spent on just about anything else?

No economist does a better job at explaining opportunity cost than Frederic Bastiat in his Parable of the Broken Window. If you aren’t familiar with it, do yourself a favor and check it out. It’s still changing the way many people think about spending and opportunity cost, and it’s 150 years old.

Businesses and Marginal Cost

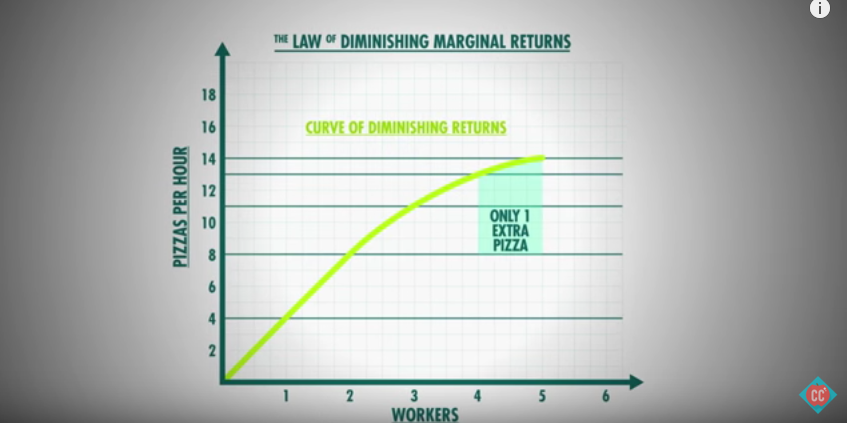

Businesses use this same logic. They calculate their potential revenue and their costs of production, including implicit costs, to make informed decisions […] eventually, they’ll get to a point where hiring another worker only adds one more pizza to their hourly total. Now, the marginal cost of that last pizza is huge. And, it’s likely to be higher than the additional revenue the company is gonna get from selling that pizza.

Crash Course then moves on to talk about a different subject without reaching the obvious conclusion: the business would not hire that additional worker.

This principle of marginal cost will be very important when talking about the minimum wage, which will have its own episode. Crash Course has already stated in a previous episode that some universal economic principles do not apply when talking about the minimum wage, so we’ll see how they reconcile their lessons on marginal cost and price floors with the minimum wage when we get to it.

Economic Profit, Normal Profit, and Competition

So there’s actually two types of profit. Accounting profit, which is revenue minus just explicit costs, those traditional out-of-pocket costs you think of when you run a business. And there’s Economic profit which is revenue minus explicit and implicit costs — which is those indirect opportunity costs.

The idea of the two-profit system was a little confusing to me at first, and I still think it causes more confusion than helpful understanding of economics. Basically, economic profit occurs when a business creates or dominates a market before other competitors enter the market to take away profit share. Economic profit is zero when you have a competitive market, since it is theorized that normal profit will equal the opportunity cost of doing something else. This is all pretty theoretical and not very helpful since it’s tough to think about a business’s opportunity cost (although it may be easy to determine a person’s opportunity cost), and the term “economic profit” is not used too frequently from what I’ve read.

Competition will lower the price and reduce your sales. New vendors will continue to enter until all that extra profit disappears […]

But remember, this is only in very competitive markets that have low barriers for entry. If it’s hard for other companies to enter a market than a business can earn economic profit.

Another great economic principle that Crash Course is citing here is that businesses will enter markets with good profitability. Markets with good profitability are those will a sustainable demand for the goods, so if enough people buy a particular good, potential businesses will see the increased demand in the market and try to move in to compete for those profits.

But unlike Crash Course might be suggesting, this can also happen in markets with high capital barriers to entry. For example, creating and manufacturing smart phones is very capital intensive, but yet there are currently numerous competitors in the market, each fighting for a share of the profit. On the other hand, high regulatory barriers to entry are much harder to overcome and will reduce the number of competitors in the market.

This was a pretty great episode for Crash Course. The rest of the episode on economies of scale, sunk costs, and marginal return are spot on and don’t require further comment. This week was pretty unobjectionable, which is a relief for us at Crash Course Criticism.

Thanks for reading, and you can look forward to a new episode reviewed every Thursday! And don’t forget to join our newsletter and our facebook group, and comment below!