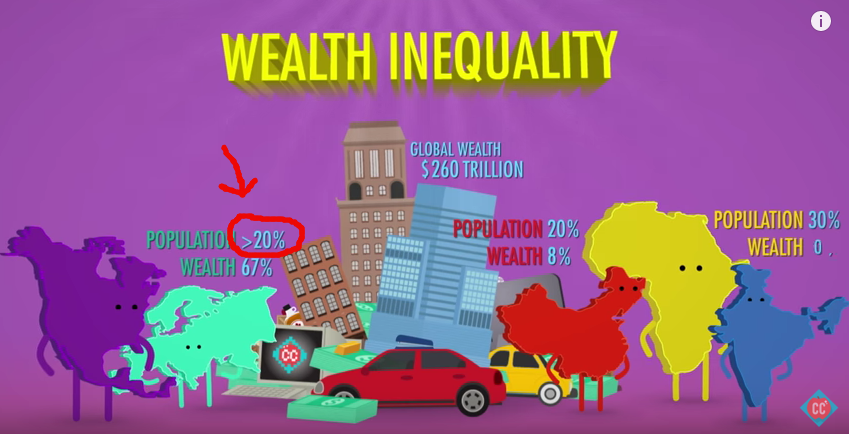

After last week’s polarizing (and pretty political) episode on wealth inequality, Crash Course decided to take it easy on us here at CCC by talking about an area of economics that is relatively noncontroversial (at least currently): Microeconomics. This episode was very solid on basic content, but as always, we have some critiques to make. Let’s do it!

Marginal Analysis and Utils

For economists, the word “marginal” is pretty much the same as “additional”. Marginal analysis looks at how individuals, businesses and governments make decisions. Basically, they’re interested in additional benefits and additional costs.

Businesses do the same thing when they decide how many workers to hire. They compare the additional revenue that an additional worker will likely generate for their company, and to the additional cost of hiring that worker: wages and benefits.

I couldn’t have said it better myself. When a person makes a decision, it is assumed in Economics that he weighs the cost and benefits, and a person would never make a decision where he believed the costs outweighed the benefits.

It’s important to note here, that these costs and benefits cannot be measured, since the decision comes down to one person’s action, and what matters to him is his subjective belief of what the costs and benefits are. We, as economists, cannot quantify what a person’s costs and benefits are from what they should be.

Speaking of this subjectivity, let’s talk about Utils:

Economists have even made up a new word to help quantify satisfaction called ‘utils’. Utils are like happiness points and they are completely subjective. So one person might get 100 utils of satisfaction from the first slice of pizza and another person might only get 10 utils.

Some economists, namely from the Austrian School, have problems with the idea of Utils. Economists might be able to guess how much value a person puts on a slice of pizza, but they can never know. In fact, the person himself might not be able to quantify it accurately.

To Austrians, the idea of Utils is helpful for explaining that people have different subjective values for things, but Utils should not be used to quantify the comparative difference between two things. As an observing economist, we can only notice when someone chooses one option over another, but we can’t quantify how much someone prefers one option over another.

This is the problem that one runs into when considering Mr. Clifford’s park example:

Instead, the government looks at the additional benefit or satisfaction generated by the fourth city park and compares that to the additional cost, and here, when we’re talking about cost, we’re talking about the use of city land, and the tax money spent on building the park.

In this case, the government has to guess as to what is the additional benefit or satisfaction generated by the park. The general dollar cost can be predicted (assuming the money has already been collected from taxpayers and is sitting in the treasury), but the benefit must be arbitrarily determined by someone judging how people feel about parks.

Imagine you are grocery shopping for a friend. You might know your friend pretty well, and you probably know what he would generally pick up at the grocery store. However, even though you might get close to what he would buy, it probably would not match what he would have bought had he been shopping.

This is the problem that many economists have with government decisions for spending taxpayers’ money. Although in the end, people might really like the park, we have no idea what they would have preferred to spend the money on.

Diamonds and Water

Crash Course does a great job at extrapolating the idea of marginal utility to the supply and demand curve. For the major examples of how supply affects price, they compare the goods of water (high supply, low price) and diamonds (low supply, high price).

Before we get into a discussion about the De Beers diamond company and how they are artificially keeping the supply of diamonds low, for this example let’s just assume that the natural supply of diamonds is low.

Crash Course pretty much nails it in this segment, although they do slip up in their wording:

It might seem irrational that society values diamonds more than water, but using marginal analysis, it sort of makes sense.

Whoa, whoa. No one is saying society values diamonds more than water, but they do value an additional diamond more than an additional gallon of water. I don’t want to be a nitpicker here, but in this case, there is a big difference and it’s important to keep the terminology consistent.

This episode was pretty spot on (aside from the few hiccups I mentioned), and I would say it’s mostly recommendable for economists from all different schools. Thanks for going easy on us this week, Crash Course!

Like what I wrote? Hate it? Have anything to say about the episode? Drop some feedback in the comments.